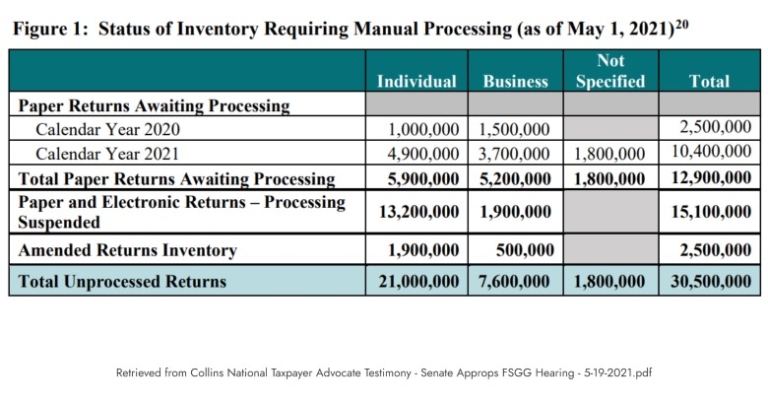

If we need more information or need you to verify that it was you who sent the tax return, we will write you a letter. "If we can fix it without contacting you, we will. As the return is processed, whether it was filed electronically or on paper, it may be delayed because it has a mistake including errors concerning the Recovery Rebate Credit, missing information, or suspected identity theft or fraud," said the IRS. "Tax returns are opened and processed in the order received. IRS moved the goalpostsĪs noted, despite the usual turnaround time for tax refunds being 21 days, the IRS confirmed that it could take up to four months to receive the money you are owed, thanks in part to the large backlog. "I have seen that people were waiting for even five, six months even though the returns were electronically filed and even though the standard time is still 21 days," added Aggarwal. In addition, the IRS have pointed the COVID-19 pandemic and the fact that many workers have been forced to work from home, while several IRS offices across the USA have closed. "They're short-staffed, it takes months and months to process those returns." "Once the holdup is there, the IRS is so backlogged right now in that everything is so very long," said CPA Aradhana Aggarwal. It is thought that the majority of delays when it comes to tax refunds is down to an error or inaccurate information on your return, with issues arising from stimulus money, the child tax credit, or earned income tax credit being at the top of the list. Why is your tax return still being processed?

Even though the IRS will issue most refunds in less than 21 days, it’s possible that. If your return includes a claim.1 answer Top answer: The IRS will issue most refunds in less than 21 calendar days. In late October the IRS reported that there were nearly nine million taxpayers who were awaiting their 2020 tax refund, with backlogs being the main reason behind the delay. Your return has been flagged for identity theft or fraud. A few examples are mailing a paper return, not choosing direct deposit, having errors on a return, missing documentation, and returns identified for additional review.Many people in the United States will have already been sorting their 2021 tax return, but there are some citizens who are still waiting for their 2020 tax refund. Various things can delay return processing.

The majority of these refunds are issued before the end of May. The Department issues $825 million in individual income tax refunds per calendar year. Please check your refund status at Where's My Refund. The anticipated time frame for refund processing is 30 days. When your return is complete, you will see the date your refund was issued. Taxpayer Services will not be able to provide further information if you call. The information on Where's My Refund, available on our website or over the phone at 51 or 80, is the same information available to our Taxpayer Service representatives. If you submitted your return electronically, please allow up to a week for your information to be entered into our system. Use Where's My Refund to check the status of individual income tax returns and amended individual income tax returns you've filed within the last year.īe sure to use the same information used on your return: Social Security Number, Tax Year, and Refund Amount. Track Your Refund About Where's My Refund

0 kommentar(er)

0 kommentar(er)